- Boston

- Chicago

ASSIGNMENT

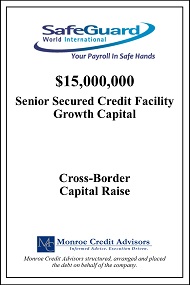

UK-based SafeGuard World International, a leading international provider of global payroll, employment outsourcing and human resource management, engaged Monroe Credit Advisors to structure and arrange a credit facility to finance growth and technology initiatives. While the company had achieved rapid revenue growth and penetration since inception, the business had consumed cash resulting in low or negative historical EBITDA. Monroe Credit Advisors was tasked with finding a lender that would understand the key credit attributes of the business and could invest in a UK parent holding company.

EXECUTION

Despite the lack of historical cash flow, Monroe’s loan thesis was focused on the company’s business model built around contracted and predictable revenue with well-known international clients as well as significant enterprise value confirmed via interest from a number of private equity investors. A pre-screened group of potential US and UK venture debt and growth debt capital lenders was identified and Monroe began executing its process seeking debt options for the company. A number of strong term sheets were received from UK banks that invest in high growth businesses as well as private debt funds. Monroe worked with management to negotiate the term sheets and drive the optimal pricing and structure. After the lender was selected, Monroe guided the process towards a successful closing.

Copyright © Monroe Credit Advisors LLC. All rights reserved.